- Home

- »

- Biotechnology

- »

-

Multiomics Market Size, Share And Growth Report, 2030GVR Report cover

![Multiomics Market Size, Share & Trends Report]()

Multiomics Market Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Type (Single-cell, Bulk), By Platform, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-136-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Multiomics Market Size & Trends

The global multiomics market size was estimated at USD 2.35 billion in 2023 and is projected to grow at a CAGR of 15.29% from 2024 to 2030. The market growth can be attributed to the increasing demand for single-cell multiomics and advancements in omics technologies. Moreover, the categories, such as genomics, proteomics, metabolomics, and transcriptomics are gaining momentum for healthcare purposes. The COVID-19 pandemic had a positive impact on the industry. The multiomics approaches have been considered for COVID-19 diagnosis and insights. Various studies and research were conducted to understand the multiomics role in the COVID-19 diagnosis. For instance, according to the study published by the MDPI in September 2021, multiomics technology can provide significant new insights to understand COVID-19.

In addition, large datasets generated by the high-throughput multiomics approaches possess much information that can help in therapeutic developments. The increasing interest among researchers in the field of single-cell genomics is also expected to boost market demand. According to the research published by the National Library of Medicine in March 2023, single-cell genomics has wide application scope in the field of cardiovascular disorder research. It can be utilized in heart development, Myocardial Infarction (MI), Cardiac Ischemia-Reperfusion (I/R) Injury, atherosclerosis, atrial fibrillation, cardiac hypertrophy, and heart failure. The industry is expected to witness significant growth due to increasing demand for single-cell multiomics. Companies are developing novel single-cell platforms.

For instance, in February 2023, BD (Becton, Dickinson, and Company) introduced a single-cell multiomics platform, BD Rhapsody HT Xpress System, to help in scientific discovery in various fields, including genetic disease research, immunology, cancer and chronic disorder research. Furthermore, the growing complexities of handling and interpreting large volumes of genomics data have resulted in the launch of several data analysis platforms. In October 2022, Almaden Genomics launched a genome platform for accelerating genomic discovery and streamlining genomic workflows. In March 2022, ARUP launched a new bioinformatics platform to provide faster, better, and more reliable next NGS test results. These developments are mainly aimed at enhancing the clinical potential of genomics across various domains of healthcare.

Multiomics approaches have been used to study cardiovascular disease (CVD) and to identify potential biomarkers and therapeutic targets. By analyzing multiple omics data, such as genomics, transcriptomics, proteomics, and metabolomics, researchers can gain a more comprehensive understanding of the underlying mechanisms of CVD. As the prevalence of CVDs is increasing significantly, it is expected to support market growth. According to the World Health Federation's World Heart Report 2023, CVDs continue to affect over 500 million people worldwide and reported 20.5 million deaths in 2021, which is nearly one-third of all global deaths. This is an increase from the previously estimated 121 million deaths caused by CVDs.

Market Concentration & Characteristics

The market has seen a significant degree of innovation in recent years. With the integration of various omics technologies, such as genomics, proteomics, and metabolomics, researchers can gain a more comprehensive understanding of biological systems. This has led to the development of new tools and technologies that enable more efficient and accurate analysis of complex biological data. As a result, the multiomics market is expected to continue growing in the coming years, with new advancements in the field.

The level of M&A (mergers and acquisitions) activities in the market has been significant in recent years. With the increasing demand for personalized medicine and the need to integrate multiple omics data types, many companies are looking to expand their capabilities through strategic partnerships and acquisitions. For instance, in March 2021, Integrated DNA Technologies, a wholly-owned subsidiary of Danaher, completed the acquisition of Swift Biosciences. The latter manufactures and develops genomics kits for research applications concerning NGS library preparation

The impact of regulation on the market is significant. With the generation of large-scale multiomics datasets, concerns regarding data privacy and security become important. Regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., impose stringent requirements for the collection, storage, and sharing of personal health information

Product expansion in the market involves the development and commercialization of innovative technologies, tools, and services aimed at advancing research, diagnostics, and therapeutics across various omics domains. Companies are developing integrated omics platforms that enable simultaneous analysis of multiple molecular layers. These platforms facilitate experimental workflows, improve data consistency, and facilitate comprehensive insights into complex biological systems

The multiomics market has been witnessing significant growth in recent years, with many companies looking to expand their reach regionally. This expansion is being driven by the increasing demand for personalized medicine and the growing awareness of the benefits of multiomics in disease diagnosis and treatment. For instance, in June 2022, Agilent Technologies leveraged AWS and NVIDIA technologies to enhance the speed of analysis of its genomics bioinformatics pipelines

Product & Service Insights

The product segment dominated the overall market with the largest revenue share in 2023 and is expected to grow at a CAGR of 13.73% from 2024 to 2030. The segment's growth is anticipated to be propelled by the surge in developments and rising number of product launches. Companies are engaging in partnerships to innovate and create novel platforms and instruments for multiomic research and analysis. For instance, in April 2023, Bio-Techne and Lunaphore announced the collaboration aimed at developing a fully automated spatial multiomics solution.

These advancements are expected to fuel the segment's expansion throughout the forecast period. Moreover, technological advancements have led to the development of more efficient, user-friendly products, enhancing accessibility for researchers. For instance, in April 2023, Bio-Techne and Lunaphore partnered to develop a fully automated spatial multiomics solution, enabling same-slide detection of protein and RNA biomarkers. The collaboration aimed to enhance understanding of the disease and expedite therapeutic development. Hence, boosting the market growth.

Type Insights

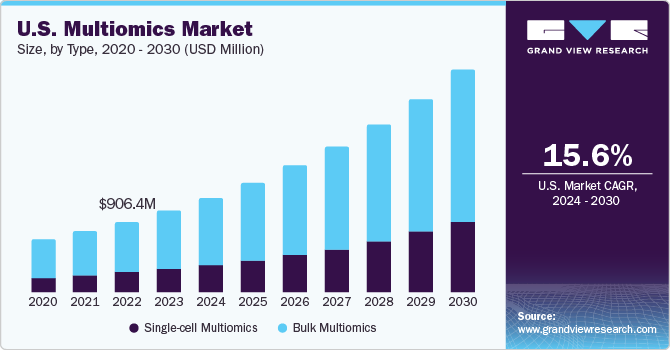

The bulk multiomics segment held the largest market share in 2023. Typically, bulk multiomics is essential for systematically explaining disorder pathogenesis and different phenotypes at the individual level. The various advantages of bulk multiomics can be attributed to the segment's dominance. These advantages include a simple experimental process and affordable large-scale sample dissection. Moreover, bulk multiomics approaches do not need living cells. The single-cell multiomics segment is expected to exhibit a CAGR of 17.78% from 2024 to 2030.

Single-cell multiomics technologies have transformed molecular cell biology by integrating various single-modality omics methods, including transcriptome, genome, epigenome, epitranscriptome, proteome, and metabolome profiling. These approaches enable a comprehensive characterization of cell states and activities at the single-cell level. This comprehensive review includes discussions on established and cutting-edge single-cell multiomics technologies, emphasizing advancements in throughput, resolution, modality integration, uniqueness, & accuracy over the past decade and further boosting the market growth.

Platform Insights

The genomics segment accounted for the largest share of 40.62% in 2023. There has been development of several advanced products in the genomics industry. Moreover, companies are increasing their offerings in this segment, which further propels segment growth. For instance, in May 2023, Google Cloud introduced an AI-powered Multiomics Suite. This offering can help in the interpretation of genomic data and in designing precision treatments. Thus, launches focusing on genomic data interpretation are expected to drive segment growth over the forecast period.

The metabolomics segment is expected to show lucrative growth during the forecast period. Metabolomics contributes to understanding the underlying metabolic disruptions in diseases, identifying new therapeutic targets, and discovering biomarkers for disease diagnosis & therapeutic monitoring. Despite challenges in standardization and the evolving nature of metabolomic methods, it holds great promise for advancing the understanding of physiology, disease mechanisms, and responses to external factors, offering new opportunities for discovery & innovation in healthcare.

Application Insights

The oncology segment dominated the overall market with the largest revenue share in 2023 and is expected to grow at the fastest CAGR of 17.99% from 2024 to 2030. The rising incidence of cancer and the growing use of multiomics for cancer are anticipated to drive segment growth. Researchers and companies are undertaking numerous efforts to help cancer patients using multiomic approaches. For instance, in September 2022, Freenome, a biotech company, launched the Sanderson Study, combining its multiomics platform with real-world data to identify multiple cancers. Furthermore, strategic investments by key players in cancer research support segment growth.

For instance, in June 2023, the collaborative efforts of Owkin, NanoString, and renowned cancer research institutions led to the launch of MOSAIC—a groundbreaking USD 50 million spatial omics project with the potential to redefine cancer research. By analyzing 7,000 tumor samples, MOSAIC leverages the power of Artificial Intelligence (AI) to unravel the intricate structures of tumors, paving the way for transformative breakthroughs in the treatment of complex cancers. This integration of spatial omics and AI in oncology multiomics not only elevates our understanding of tumor biology but also holds the promise of discovering novel biomarkers, marking a significant stride toward personalized and more effective cancer treatments.

End-use Insights

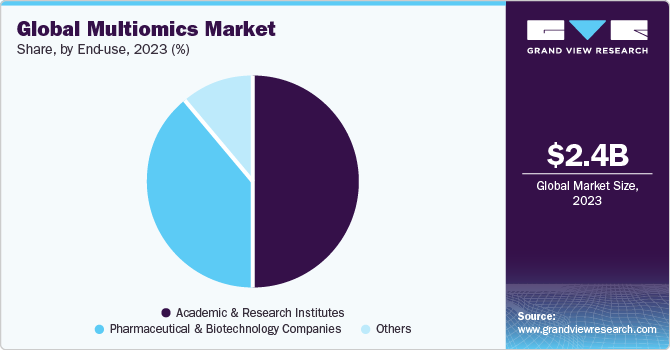

The academic & research institutes segment held the largest market share of 50.29% in 2023. Increasing studies and research focusing on multiomics approaches, including genomics, proteomics, metabolomics, and transcriptomics, are anticipated to drive segment growth over the forecast period. Moreover, this segment is receiving funding and investment for conducting research in this field. For instance, in September 2023, the National Institutes of Health established the Multiomics for Health and Disease Consortium and provided USD 50.3 million for multiomics research. This consortium includes professionals from various universities, including the University of California, Columbia University, and Washington University.

The pharmaceutical & biotechnology companies segment is expected to show lucrative growth during the forecast period. Pharmaceutical and biotechnology companies are engaged in large-scale omics sequencing projects by collaborating with community health systems as well as academic medical centers. For instance, in January 2023, Eurofins Scientific expanded its regional presence by entering the Indian pharmaceutical market by launching a new state-of-the-art facility in Hyderabad. The growing interest of pharmaceutical and biotechnology companies in multiomics is expected to drive market growth.

Regional Insights

The North America multiomics market held the largest share of 48.64% in 2023. The presence of key players in the region supports its highest revenue share. Moreover, companies are undertaking efforts to strengthen their presence, which is also fueling regional market growth. For instance, in February 2023, Tempus, a U.S.-based company, collaborated with Actuate Therapeutics to help discover and further validate biomarker profiles in cancer patients. Tempus is using the multiomics approach in this project to improve research and increase novel scientific insights. Such strategies are driving regional expansion.

U.S. Multiomics Market Trends

The multiomics market in the U.S. is highly competitive due to the growing demand for comprehensive biological insights fueled by advancements in omics technologies. This competition is intensified by active R&D efforts in academia and industry, with institutions and companies vying for funding and breakthrough discoveries. For instance, in 2023, the Keck School of Medicine at the University of Southern California (USC) secured a significant 5-year, USD 50.3 million research grant from the National Institutes of Health (NIH). Other factors attributed to the significant adoption of multiomics technology in this country are sophisticated research & medical infrastructure, funding, skilled personnel, and companies pushing for better research methods to identify newer technologies for diagnosis & therapies.

Europe Multiomics Market Trends

The Europe multiomics market is expected to witness significant growth. Europe has a robust research infrastructure and a strong tradition of investing in scientific research. Government funding agencies, along with private institutions and pharmaceutical companies, allocate significant resources to support metagenomics research initiatives. This funding drives innovation, facilitates collaboration, and accelerates the development of multiomics technologies and applications.

The multiomics market in the UK held a significant share in 2023. The UK government has shown a commitment to advancing genomics and multiomics research through funding initiatives, including Genome UK and the NHS Genomic Medicine Service. These initiatives aim to make genomic and multiomics data more accessible for research and healthcare. For instance, in September 2022, the National Human Genome Research Institute (NHGRI) awarded around USD 3.35 million over 5 years to introduce the Genome Research Experiences. The initiative will help develop partnerships with universities and allow undergraduate students to conduct genomic research. These factors are anticipated to support the UK market growth.

The France multiomics market is expected to grow in the near future due to extensive government initiatives that are boosting the adoption of NGS solutions in the country. Since 2013, the French National Cancer Institute (INCa) has supported the implementation of targeted NGS as part of routine clinical practice. In addition, France implemented a national plan, the 2025 France Genomic Medicine Initiative, to ensure adequate access to genomic medicine for all patients. This initiative is dedicated to introducing genome sequencing to the care pathway.

The multiomics market in Germany is witnessing substantial growth in the multiomics field, characterized by active participation from renowned academic institutions, biotech & pharmaceutical companies, and government funding for research projects. For instance, in 2021, the European Molecular Biology Laboratory (EMBL) in Germany hosted a series of events and courses with a primary focus on the integration and analysis of multiomics data. These initiatives serve as a forum for the exchange of ideas and the presentation of approaches to multiomics data integration that extend beyond merely describing the data, with the overarching goal of achieving a deeper, mechanistic understanding of biological interpretation.

Asia Pacific Multiomics Market Trends

The Asia Pacific multiomics market is expected to grow at the fastest CAGR during the forecast period. This is driven by substantial advancements in metagenomics adoption across diverse applications in India and China. The region's emphasis on genomics and proteomics research, combined with proactive initiatives from academic institutions to advance sequencing technologies, is creating lucrative growth prospects throughout the forecast period.

The multiomics market in China is expected to grow over the forecast period. Owing to the presence of prominent NGS sequencing centers, such as BGI, China accounts for a significant share of the global market. Furthermore, institutes, such as BGI, have integrated NGS platforms and applications, such as prenatal screening, oncology, idiopathic, and infectious disease investigation & research. In addition, BGI has reportedly installed over 120 HiSeq 2000 genome sequencers by Illumina. Thus, BGI NGS laboratory in Hong Kong is among the few very high-capacity next-generation genome sequencing facilities.

The Japan multiomics market is witnessing rapid growth. Healthcare and clinical research service providers in Japan have been progressively incorporating sequencing technologies over the past few years and are projected to play a significant role in the Asia Pacific genomics revenue share. For instance, in April 2022, the Okinawa Institute of Science and Technology Graduate University (OIST), in collaboration with Tokyo-based Corundum Systems Biology Inc., introduced a research project aimed at developing a complete automated system for disease prediction by fiscal year 2024.

MEA Multiomics Market Trends

The multiomics market in MEA is growing due to the increasing adoption of high-throughput sequencing technologies and growing demand for personalized medicine and disease diagnosis. One of the major trends in the MEA market is the increasing focus on R&D activities by academic and research institutions. This is driving the demand for high-throughput sequencing technologies, as well as bioinformatics tools for the analysis and interpretation of metagenomic data. In addition, the region is witnessing increasing government support for R&D in the field of metagenomics, which is expected to boost market growth. However, challenges, such as the need for more skilled professionals and high cost of multiomics technologies, hinder market growth to some extent.

The Saudi Arabia multiomics market is expected to grow over the forecast period due to the increasing prevalence of chronic diseases, high demand for personalized medicine, and rising focus on drug discovery & development. In addition, there are some initiatives in Saudi Arabia related to biobanking and genomics research that drive market growth. For instance, the National Biobank in Saudi Arabia was inaugurated in 2022 to enhance the public health system and effectively contribute to supporting the research, development, and innovation agenda.

The multiomics market in Kuwait is anticipated to grow significantly over the forecast period owing to various factors, such as increasing exports and a growing economy. With substantial developments in its healthcare infrastructure, the country is addressing the rising incidence of infectious diseases, chronic ailments, and lifestyle-related health issues. Moreover, government initiatives to boost scientific research and innovation in genetic diseases drive market growth.

Key Multiomics Company Insights

Key players seek product approvals to increase the reach of their products and improve their availability in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Multiomics Companies:

The following are the leading companies in the multiomics market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Thermo Fisher Scientific, Inc.

- Illumina, Inc

- Danaher (Beckman Coulter)

- PerkinElmer, Inc

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI Genomics

Recent Development

-

In January 2024, BD announced the collaboration with Hamilton Company. Through this collaboration, the company focuses on developing robotics-compatible and automated applications reagent kits to standardize and reduce human error in large-scale single-cell multiomics experiments

-

In January 2024, Thermo Fisher Scientific Inc. collaborated with Akoya Biosciences, Inc. for a license and distribution agreement to deliver a combined solution for spatial multiomics workflows. The agreement enables a simplified process for whole-slide, multiomic imaging. This combined approach provides a more comprehensive understanding of cell phenotypes and conditions by examining protein and RNA, which is crucial for fields in cancer research

-

In November 2023, Illumina introduced an advanced liquid biopsy assay designed to facilitate comprehensive genomic profiling of solid tumors

-

In September 2023, Bruker introduced novel 4D-Proteomics timsTOF, which offers precise quantification of peptides & proteins within hundreds or thousands of samples by employing global retention time and Collision Cross-Section (CCS) prediction models

-

In January 2023, Agilent Technologies, Inc. announced the acquisition of Avida Biomed, a company that develops target enrichment workflows for clinical researchers utilizing NGS methods to study cancers

Multiomics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.72 billion

Revenue forecast in 2030

USD 6.38 billion

Growth rate

CAGR of 15.29% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, type, platform, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope

Global Multiomics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the multiomics market report based on product & service, type, platform, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Instruments

-

Consumables

-

Software

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-cell Multiomics

-

Bulk Multiomics

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Transcriptomics

-

Proteomics

-

Metabolomics

-

Integrated Omics Platforms

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Biology

-

Oncology

-

Neurology

-

Immunology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic and Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global multiomics market size was estimated at USD 2.35 billion in 2023 and is expected to reach USD 2.72 billion in 2024.

b. The global multiomics market is expected to grow at a compound annual growth rate of 15.29% from 2024 to 2030 to reach USD 6.38 billion by 2030.

b. North America dominated the multiomics market with a share of 48.64% in 2023. This is attributable to large number of service providers and end users within the region

b. Some key players operating in the multiomics market include BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI

b. Key factors that are driving the market growth include increasing advancements in omics technology and decreasing costs of omics technologies

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."